Private equity: robust performance over the long term, outperforming other asset classes

05 July 2023

France Invest (Association of Investors for Growth) and EY are today presenting the 29th edition of their annual study on the net performance at the end of 2022 of French private equity players (private equity and infrastructure funds).

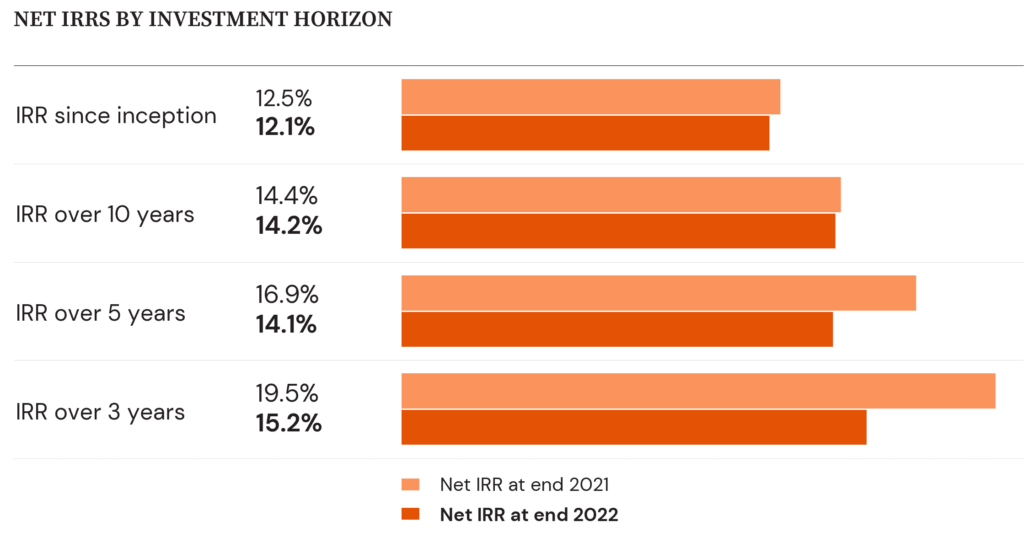

| Key lessons: 1) Robust performance to the end of 2022 (14.2% net per annum over 10 years) 2) A slight decline over the year (performance over 3 years at 15.2% net per annum compared with 19.5% at the end of 2021, a year of strong recovery) 3) Outperforms all other asset classes over the long term, demonstrating the ability of supported companies to create value across cycles |

Bertrand Rambaud, Chairman of France Invest, comments: “After a strong recovery in 2021 following the end of the health crisis, 2022 marks a return to the average. The slight fall in yields seen this year can be explained by a downturn in the tech sector, a more uncertain economic environment and inflationary pressures. Over the longer term, the industry continues to deliver robust returns for its subscribers, outperforming all other asset classes over the long term. Through these cycles, the companies we support adapt and maintain the process of value creation in their businesses. This is how French private equity helps to strengthen our economy in the long term.”

A/ Consistently robust performance over the long term

At the end of 2022, despite a more uncertain environment in recent months, long-term performance is consolidating at a high and stable level at 14.2% per year over 10 years[1].

The year 2022 was marked by macroeconomic developments (inflation, rising interest rates, rising energy costs, falling financial markets, etc.) which brought the economic situation back to normal after the strong recovery seen in 2021. The downturn in the tech sector and the overall adjustment in valuations across all segments should also be taken into account. As expected in this context, private equity returns at the end of 2022 are falling slightly.

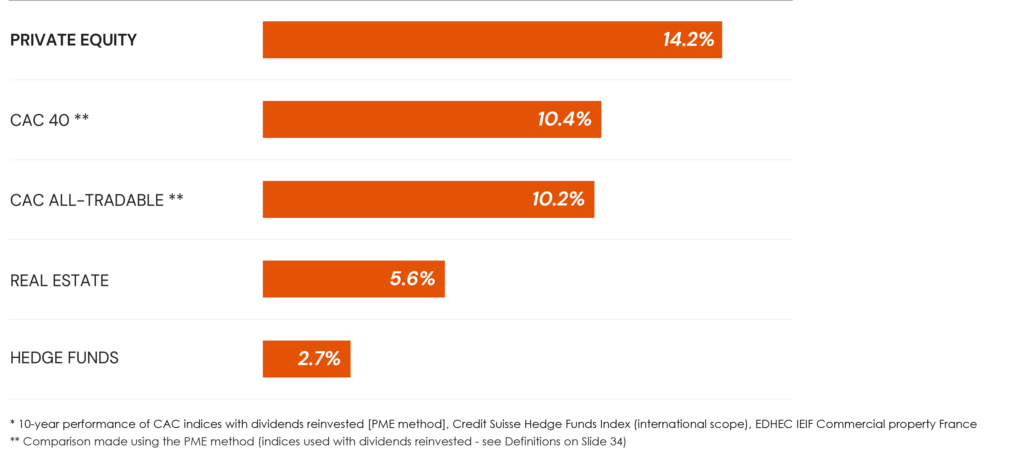

B/ Outperforms all other asset classes over the long term, demonstrating the ability of supported companies to create value across cycles

Private equity outperforms all other asset classes over the long term.

Whatever the segment selected (venture & growth, development capital, buyout capital, mixed vehicles, infrastructure funds), long-term performance is high.

This outperformance bears witness to the value-creation capacity of the companies we support, and to the ability of private equity funds to support their investments over the medium and long term, so that they perform better through economic cycles.

“The 2022 performance of private equity measured over 10 years (14.2%), albeit slightly down on last year, maintains a significant yield differential of around 4 points compared with the CAC 40 or CAC All Tradable stock market indices,” points out Stéphane Vignals, partner at EY Strategy and Transactions. “This demonstrates the resilience of private equity across economic cycles and the ability of private equity players to have effectively supported the management teams of the companies in which they invest in the situation of inflationary and geopolitical tensions that we experienced in 2022” adds Stéphane Vignals.

Methodological reference: See footnote[2]

[1] Given the average lifespan of vehicles (between 8 and 10 years) and the length of time over which investments are made, the final performance of vehicles is built up over the long term: the most relevant performance indicators are those relating to horizons of at least 5 years, particularly performance over 10 years or since inception.

[2] Note: 2022 scope and calculation method

As with previous years’ studies, the 2022 edition is based on data that is broadly representative of the French market: it covers almost 900 vehicles managed by 146 management companies. The number of vehicles covered has risen sharply since 2017. In addition to growth in the market and in the number of players, it is also due to the long-term viability of those players who have demonstrated repeated good performance with their subscribers.

All the reports on the net performance of French private equity players

The net performance of French private equity players study is carried out by France Invest and EY.

- Net performance of French private equity players at end 2019

Methodology and definition

The France Invest / EY study on the performance of French private equity players has been the benchmark for the French market since 1994.

It is based on information reported by France Invest members via a European data collection platform (European Data Cooperative), and reviewed by EY, which ensures the consistency and robustness of the statistics published.

Net IRR corresponds to the net IRR calculated since inception (1987), taking into account all the flows of mature funds built up since 1987. It is calculated over a variable period, starting from a fixed inception (1987 in our study).

The net IRR over 10 years corresponds to the net IRR calculated over the last 10 years from 31 December 2022, taking into account all the flows of mature funds for which a net asset value (SCR) or estimated value (FCPR) is available at the start of this period, i.e. 31 December 2012. We then consider the assets or estimated value of the fund at 31 December 2012 as the theoretical investment at the start of the period. It is calculated for a fixed term, over a rolling period (at the end of 2022, the 10-year IRR is calculated over 2013-2022).

Net IRR is the IRR achieved by a subscriber on his or her investment in a private equity vehicle (venture capital mutual fund (FCPR), venture capital company (SCR), Limited Partnership, etc.). It takes into account negative flows relating to successive calls for funds and positive flows relating to distributions (in cash and sometimes in securities) as well as the net asset value of the units held in the vehicle on the calculation date.

This rate is net of management fees and carried interest.

It includes the impact of cash, the time effect and the estimated value of the portfolio.